How to Calculate Your Mortgage or home equity credit Payments?

Everyone dreams to possess their own house. A house will probably be your largest purchase. to form this dream come true, you're employed hard; you earn all of your life to shop for a house. you're taking a real estate loan and repay it throughout your life. monthly , you only pay the quantity given in your loan statements. once you pay your monthly installments, have you ever ever wondered how that figure has arrived? have you ever ever thought of trying to know the calculation of your mortgage payments? If not, now's the time.

You are spending your hard-earned money in paying for your real estate loan amount. How are you able to make certain that the mortgage company is charging you the fair amount? within the past few years, there has been tons of monetary crisis, especially within the housing sector. But people have learned from it. they're now more on top of things of their finances. they want to understand where and the way their money goes . Thus, everyone wants to understand the calculations for mortgage payments on your home.

Calculating home equity credit payments isn't a difficult task. Many home equity credit calculators are available on the web . All you would like to try to to is provide the essential details that are: the principal amount of loan, the rate of interest , and you loan tenure. you'll easily calculate your monthly payment by fixing just the above details. the house loan calculator available on our site will assist you to calculate your mortgage payment.

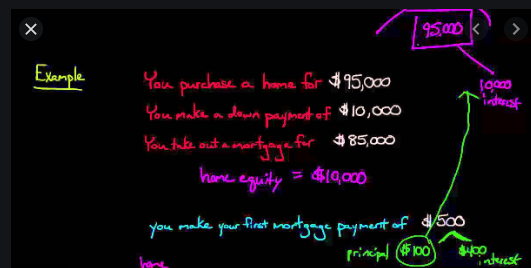

In case you would like to use for a fresh mortgage, you'll put in many combinations of the above three ingredients to urge various payment options. for instance , if your loan principal is $100,000, interest is 7% and term is 30 years, your EMI are going to be $665.30. But if you reduce the term to twenty years, the EMI are going to be $775.30. If you think that you simply pays an additional $90 monthly , you'll easily keep the tenure as 20 years. once you skills to calculate the payments, you'll see what options will suit you the foremost . this manner you'll negotiate with the lender at the time of deciding the interest and tenure and therefore the repayment schedule.

However, there are more factors that enter mortgage payments. albeit you've got calculated the loan EMIs, you would possibly find your actual monthly payments to be quite you expected. That's generally due to taxes and insurance. So after you calculate your mortgage payments, do not forget to feature the homeowner's insurance, taxes and personal mortgage insurance to urge the particular mortgage payments.

There are many benefits in learning to calculate your mortgage payments. a number of them are as follows:

• you'll be on top of things of your finances.

• you'll skills much of your payments are towards principal and the way much towards interest.

• you'll have the knowledge on what accounts for your monthly mortgage bill.

• you'll catch the occasional errors made during billing by the mortgage companies.

• you'll know whether or not you've got an honest deal on your mortgage.

• you'll reduce your mortgage cost by refinancing your mortgage if your current mortgage is charging very high.

Ryann Paul is an expert in providing information associated with best mortgage companies [http://www.mortgagebidusa.com/Best-Mortgage-Companies.html] an

Komentar

Posting Komentar